本文为新东方在线AP名师郭轶臣老师写的AP Macroeconomics预测大题必考知识点,供大家备考2015年AP考试时使用。

1. Assume the United States economy is operating at full-employment output and the government has a balancedbudget. A drop in consumer confidence reduces consumption spending, causing the economy to enter into arecession.

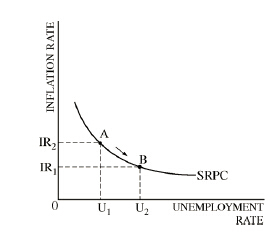

(a) Using a correctly labeled graph of the short-run Phillips curve, show the effect of the decrease in

consumption spending. Label the initial position “A” and the new position “B”.

(b) What is the impact of the recession on the federal budget? Explain.

(c) Assume that current real gross domestic product falls short of full-employment output by $500 billion andthe marginal propensity to consume is 0.8.

(i) Calculate the minimum increase in government spending that could bring about full employment.

(ii) Assume that instead of increasing government spending, the government decides to reduce personal

income taxes. Will the reduction in personal income taxes required to achieve full employment be

larger than or smaller than the government spending change you calculated in part (c)(i) ? Explainwhy.

(d) Using a correctly labeled graph of the loanable funds market, show the impact of the increased governmentspending on the real interest rate in the economy.

(e) How will the real interest rate change in part (d) affect the growth rate of the United States economy?

Explain.

2. Assume that the reserve requirement is 20 percent and banks hold no excess reserves.

(a) Assume that Kim deposits $100 of cash from her pocket into her checking account. Calculate each of the

following.

(i) The maximum dollar amount the commercial bank can initially lend

(ii) The maximum total change in demand deposits in the banking system

(iii) The maximum change in the money supply

(b) Assume that the Federal Reserve buys $5 million in government bonds on the open market. As a result of

the open market purchase, calculate the maximum increase in the money supply in the banking system.

(c) Given the increase in the money supply in part (b), what happens to real wages in the short run? Explain.

Solution:

1.

(a) 2 points:

• One point is earned for a correctly labeled graph of the short-run Phillips curve (SRPC).

• One point is earned for showing on the SRPC the initial position “A” and the new position “B”.

(b) 2 points:

• One point is earned for stating that the federal budget will be in a deficit.

• One point is earned for explaining that government spending (or transfer payments) will increase and/or tax revenues will fall due to the recession.

(c) 3 points:

• One point is earned for correctly calculating the increase in government purchases: Change in G = Recessionary gap/Multiplier = ($500/5) = $100.

• One point is earned for stating that a larger reduction in personal income taxes is required than the $100 billion increase in government spending.